SIGNIFICANT VALUE

Investment Case

The assets are a fantastic opportunity onshore Wyoming, United States. The value opportunity is incredible and could see transformation potential for the acquirer in the short to medium term.

There's great potential for resource growth and production increase through short term operational activities generating multiple catalysts for creating value across the entire asset base.

The high ROI potential is appealing in itself but there are also tax incentives and environmental benefits. The capture and use of carbon dioxide offers enormous potential to reduce environmental impacts.

This presents an ideal opportunity for both International Oil and Gas Companies or a US based business with domestic operations.

ExxonMobil's acquisition of Denbury valued at $4.9 billion demonstrates strong appetite for mergers and acquisitions. The shareholder group believe that Exxon were the JV party interested in COPL's assets and we believe they are still interested.

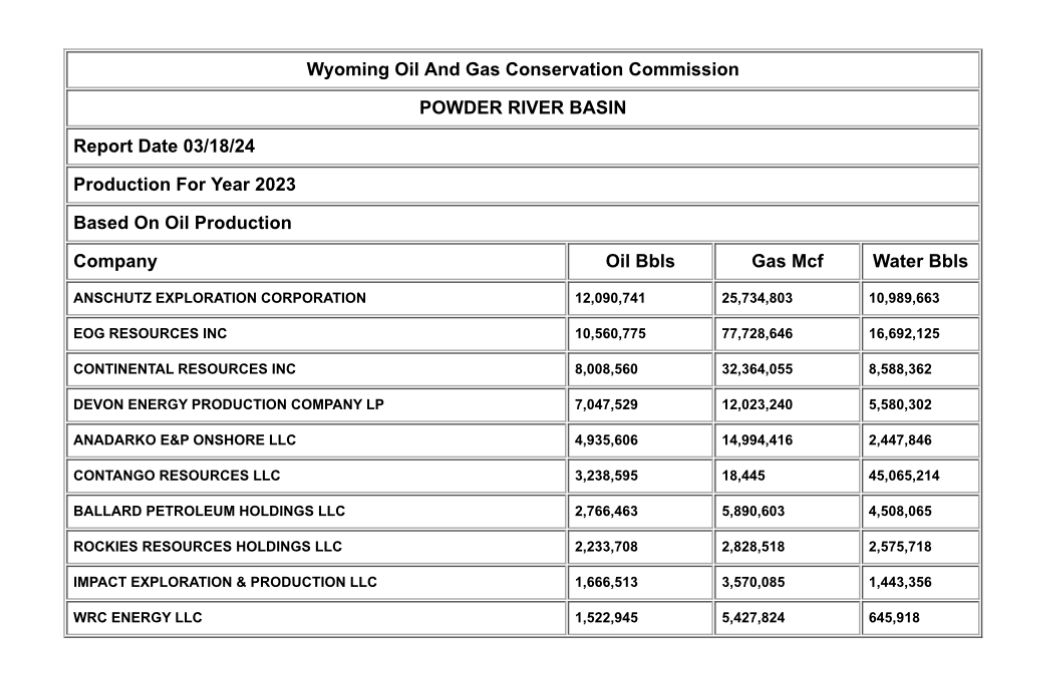

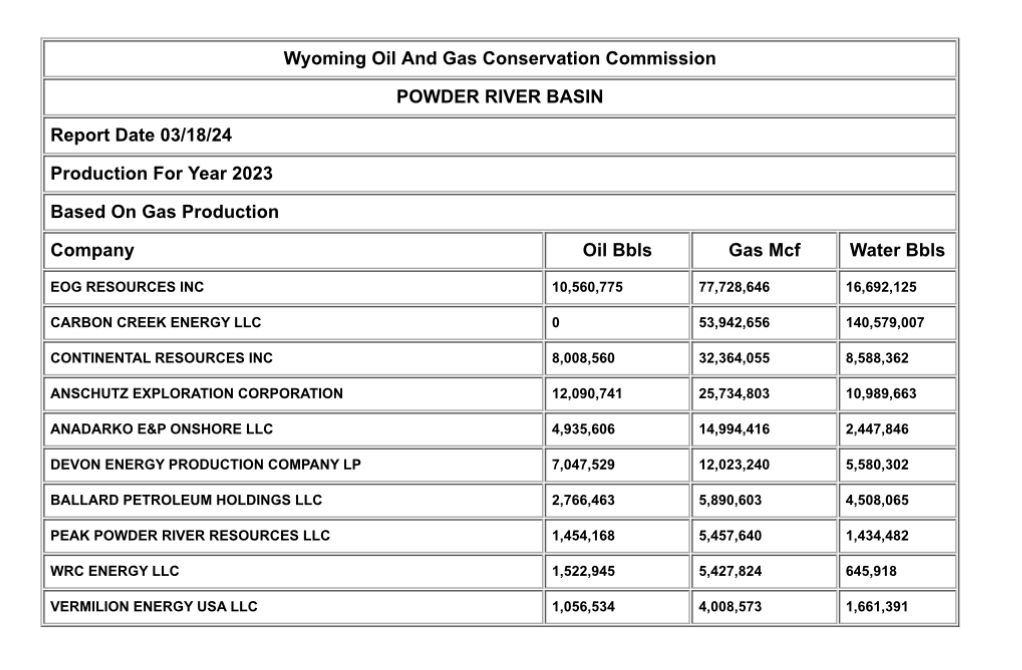

There has been other M&A activity nearby.

Chesapeake sold its Powder River Basin assets in Wyoming to Continental Resources, Inc for approximately $450 million in 2022.

Occidental Petroleum acquired Anadarko Petroleum for $55 billion in 2019. The group is Wyoming's largest private landowner and focuses primarily on developing the Powder River Basin. In late 2020, they sold some of their assets in the Powder River Basin for about $700 million to reduce their debt.

10 january 2022

Arthur Millholland

SECURE THE ASSETS

Make an offer

The data room is open. Get your bid in.

Analyse

Research the publicly available information on the Company's assets, review all available documentation and assess the investment case before attending the data room.

Decide

Decide whether the investment case is strong and how much to offer for the assets. Also, study the sales process.

KSV Restructuring Inc. was appointed as monitor in the CCAA proceedings. Visit their dedicated COPL page by visiting the link below.

Sign

If you intend to proceed with an offer, you must enter into a non-disclosure agreement and submit a letter of intent to bid by April 17, 2024 (the “LOI Deadline”).

Complete

Following the LOI Deadline, you will be entitled to submit a bid. In order to constitute a “Qualified Bid,” each bid must comply with the terms of the SISP.

All bids must be received by May 2, 2024 (the “QualifiedBid Deadline”).

Complete the transaction.