Background Information

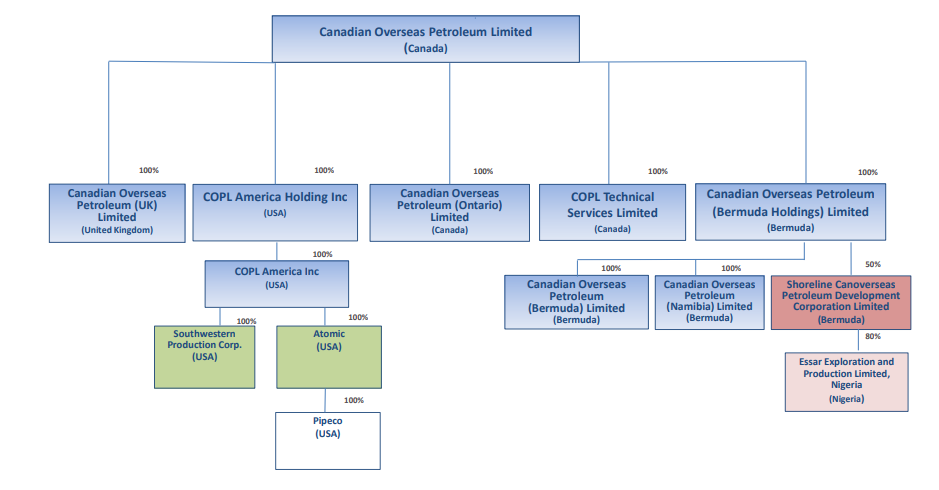

Canadian Overseas Petroleum Limited (COPL) is an international oil and gas exploration, development and production company with interests in Wyoming, USA and Nigeria.

COPL is a company registered in Canada. A summary of the company's corporate structure is given below.

The COPL Action Group ("CAG") has created this website

to inform potential bidders of COPL's assets and their true value. Our

goal is to get fair value for the company's assets.

Due to the failures of the COPL board that led to breaches on the company’s secured debt agreement, the senior lender intervened on 11 March 2024 to initiate proceedings under the Companies' Creditors Arrangement Act (“CCAA”).

According to the CAG, the Sale and Investment Solicitation Process (“SISP”) published by the Court appointed Monitor, KSV Advisory as part of the CCAA proceedings, does not take into account the true value of COPL’s assets, making it difficult for potential bidders to value the assets that are being sold. The position of the SISP along with Affidavits from Chief Restructuring Officer, Peter Kravitz do not provide a comprehensive assessment of the assets owned by COPL.

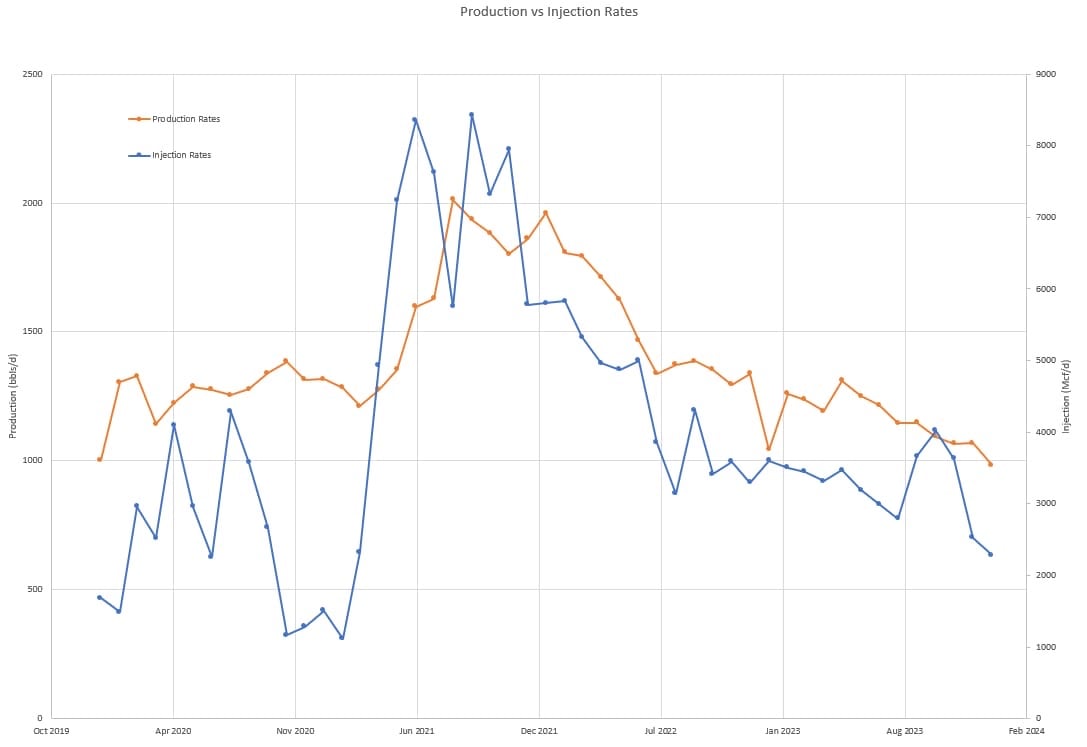

On page 47 of his affidavit, Mr. Kravitz states in section (e) that in October and November 2023, the COPL Group had increased its purchase of gas injectant required for the miscible flood to over $500,000 per month (more than double the September expenditure), but the corresponding increase in production and revenue were small, far below expectations, and thus not worth pursuing because they were weighed down by increased oil field costs.

David Brooks, a member of the Institute of Chartered Accountants in England and Wales and a former partner at KPMG, reviewed Exhibit J to which Mr Kravitz refers - the Province Variance Report. (Mr Kravitz is a Founding Principal of Province). Part of Exhibit J of the report refers to the fourth quarter of 2024. The company's quarterly reports are usually published in the middle of the following quarter. This did not happen with the figures for the fourth quarter of 2023. Therefore, we must rely on Exhibit J as an interpretation of COPL's Q4 figures. Mr. Brooks found no evidence that the $500,000 was spent on injectants for each of October and November 2023. Mr. Brooks further found that the figures referred to in Exhibit J as the "actual" revenue and expenses for September and October (pages 17 and 18) are identical, which he considered most irregular. Without access to the COPL Q4 figures, Mr. Brooks could not corroborate Exhibit J with figures published by the Company. Mr. Brooks expressed his opinion that, in short, Exhibit J "raises more questions than it answers."

Mr Rob Duncan, a Chartered Engineer (C.Eng.) specialising in the Oil & Gas industry, studied the data applicable to COPL’s Wyoming oil activities in an attempt to reconcile these with the statement made by Mr Kravitz. Mr Duncan obtained this information from the Wyoming Oil & Gas Conservation Commission (WOGCC) website where COPL and all other Oil & Gas businesses in Wyoming submit their data. Having reviewed the level of injectant recorded as well as the typical price of injectant over the period, Mr Duncan was unable to reconcile the injectant used with the $500,000 per month for October and November referred to by Mr Kravitz. The Company made similar claims relating to the volume of injectant used in its RNS’s of 6 October and 15 November. Because COPL’s operating field (BFSU) is an EOR field, the injectant is entirely fundamental to production levels. Simply put, the higher the injectant levels, the higher production is likely to be. The injectant identified by Mr Duncan in the WOGCC report was far lower than would apply had US$500,000 of injectant been used in October and November as stated.

Mr. Kravitz's affidavit totals 1,419 pages. Surprisingly, the document ignores the following important information about COPL, its assets and topics that a potential buyer will undoubtedly want to know.

1. COPL RNS dated 12 Sept 2022 confirming COPL’s 2P NPV 10% to $492 million as assessed by Ryder Scott in its report. This document demonstrated the valuable and long-lasting production assets owned by the Company. Because of this, the RNS should be included in Mr Kravitz’s Affidavit since it is an integral part of demonstrating the Company’s underlying assets. N.B. Ryder Scott is a renowned firm of experts in the Oil & Gas industry having been founded almost 100 years ago.

2. COPL RNS dated August 2022, which refers to an independent confirmation report prepared by Ryder Scott as Competent Person of the Wyoming Deep discovery previously announced by the Company. This confirmed 993.5 million barrels of oil in place which were referred to as ‘conservative estimates complying with Canadian standards’. Again, this document is essential reading to third parties wishing to collate a fair assessment of the Company and its assets.

3. It is understood that a further report from Ryder Scott exists which covers the Cole Creek area of COPL property. It is believed that this too concludes that extremely valuable assets exist in this area of COPL property and so should be included in Mr Kravitz’s sworn statement.

PARTNERSHIP

Potential Joint Venture

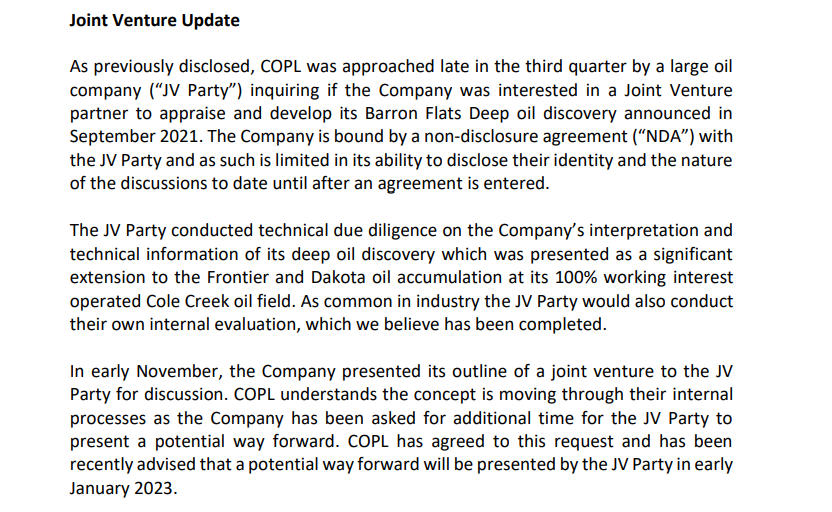

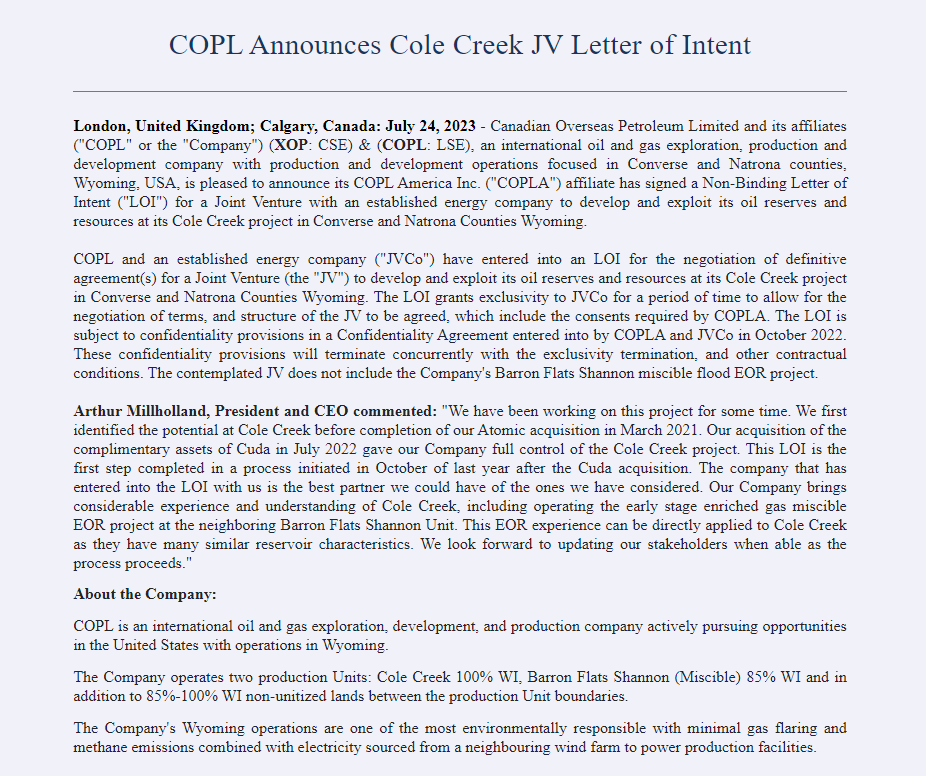

We know that before everything fell apart in December 2023, discussions about a joint venture lasted about 15 months. It has come to light that the Heads of Terms were agreed upon with the JV Party in September 2023, and only then did things about the company's financial difficulties become public.

The following update came on December 21, 2022 advising us that the Company started discussions in Q3 2022 with a "large oil company" for a Joint Venture.

The following update came on July 24, 2023 advising us that the Company had signed a Non-Binding Letter of Intent with an "established energy company" for a Joint Venture.

The following update came on September 06, 2023 advising us that the Company intends to "conclude the previously announced Joint Venture negotiations" with "a respected industry leader"

On September 6, 2023 the Company updated the market advising among other things that they had raised $3.5 million at 4p per share from Anavio. The Financing was completed later and was intended to sufficiently fund COPL in to the first quarter of 2024 for production growth and to conclude the previously announced joint venture (the "Joint Venture") negotiations. The information copied below was also within this annoucement.

Mr. Millholland's technical expertise was instrumental in understanding the long-term value of the Barron Flats Unit miscible flood and acquiring it for such a relatively low cost. Through further geological study, he and his team have revealed a vast area of bypassed oil pay in the Cole Creek area, adjacent to the BFU. The prospective horizons are currently under Joint Venture negotiation with a respected industry leader.

The following update came on December 18, 2023 advising us that "the non-binding Cole Creek JV Letter of Intent has been terminated."

The shareholder group understand that the Joint Venture was terminated by one of the Company's financiers objecting to their share of the proceeds arising from the deal and not terminated at the behest of the JV partner.

BFSU Injectant Gas

Debt Restructuring to Ensure Funding beyond Q1-2024 RNS dated 6 October 2023:

• The company has tied-in six wells and five high-pressure separators to the gas gathering system

• The company plans to spend over $500,000 on NGL injectant in each of October and November to increase the density of NGL’s in the gas injection

• The company expects to see initial results from the higher density NGL’s before the end of November 2023.”

John Cowan, CEO said:

“I am delighted to have closed this financing that now allows my entire focus to be on delivering increased production at field site through increasing Q4 NGL injectant. If we can bring production back above 2,000 bbl/d on average for 2024 it will allow us to fully fund COPLA for the entire year. We remain focused on progressing our discussions relating to the JV and look forward to being able to focus on delivering operationally.”

COPL Announces Q3-2023 Operational and Financial Results RNS dated 14 November 2023:

John Cowan, CEO said:

“Since the third quarter in 2023, COPL was able to use working capital to increase NGL injection at the BFSU at double the rate compared to recent periods. This miscible flooded field requires injection of NGLs to enhance oil production and field recovery factors as capital restraints in earlier periods restricted the rates of NGL injection. A technical review of the oil response to increase NGL injection will be monitored closely this quarter, and it will form the basis for future production guidance and 2024 plans."

COPL Announces US$2.5 Million Equity Financing, Execution of Forbearance Agreement with Senior Lender and Appointment of Chief Restructuring Officer RNS dated 29 December 2023:

“The Company has stopped natural gas and NGL purchases. Oil production for the 4th quarter, up to December 28, 2023 averaged 1,083 bbl/d (gross).”